- 8.1 Components of a Proper Application

- 8.2 Structuring the Application

- 9.1 Why is linking Aadhaar with bank account mandatory?

- 9.2 How to link Aadhaar with bank account?

- 9.3 What happens if I don’t link my Aadhaar with bank account?

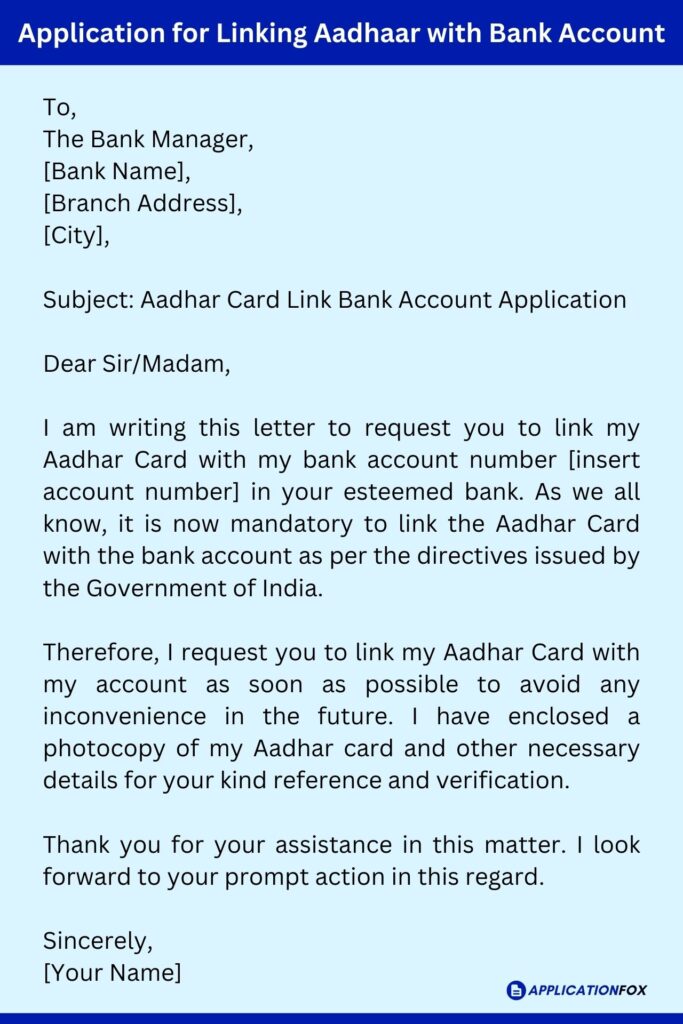

Aadhar Card Link Bank Account Application Letter Format

To,

The Bank Manager,

[Bank Name],

[Branch Address],

[City],

Subject: Aadhar Card Link Bank Account Application

I am writing this letter to request you to link my Aadhar Card with my bank account number [insert account number] in your esteemed bank. As we all know, it is now mandatory to link the Aadhar Card with the bank account as per the directives issued by the Government of India.

Therefore, I request you to link my Aadhar Card with my account as soon as possible to avoid any inconvenience in the future. I have enclosed a photocopy of my Aadhar card and other necessary details for your kind reference and verification.

Thank you for your assistance in this matter. I look forward to your prompt action in this regard.

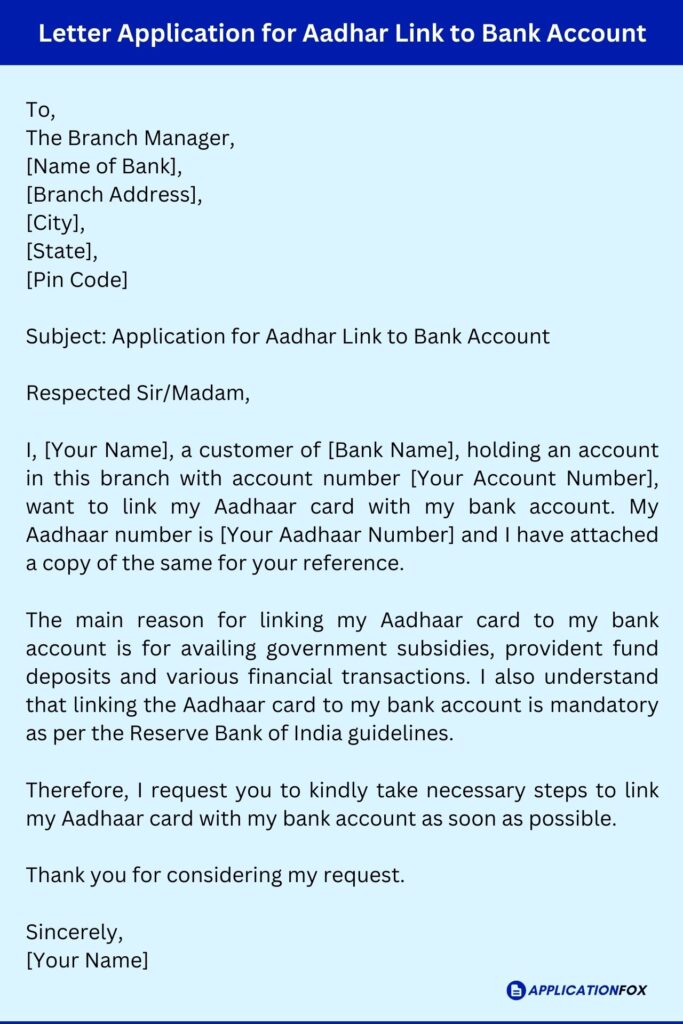

Request Letter Application for Aadhar Link to Bank Account

To,

The Branch Manager,

[Name of Bank],

[Branch Address],

[City],

[State],

[Pin Code]

Subject: Application for Aadhar Link to Bank Account

I, [Your Name], a customer of [Bank Name], holding an account in this branch with account number [Your Account Number], want to link my Aadhaar card with my bank account. My Aadhaar number is [Your Aadhaar Number] and I have attached a copy of the same for your reference.

The main reason for linking my Aadhaar card to my bank account is for availing government subsidies, provident fund deposits and various financial transactions. I also understand that linking the Aadhaar card to my bank account is mandatory as per the Reserve Bank of India guidelines.

Therefore, I request you to kindly take necessary steps to link my Aadhaar card with my bank account as soon as possible.

Thank you for considering my request.

Letter Application for Aadhar Link to Bank Account" width="454" height="681" />

Letter Application for Aadhar Link to Bank Account" width="454" height="681" />

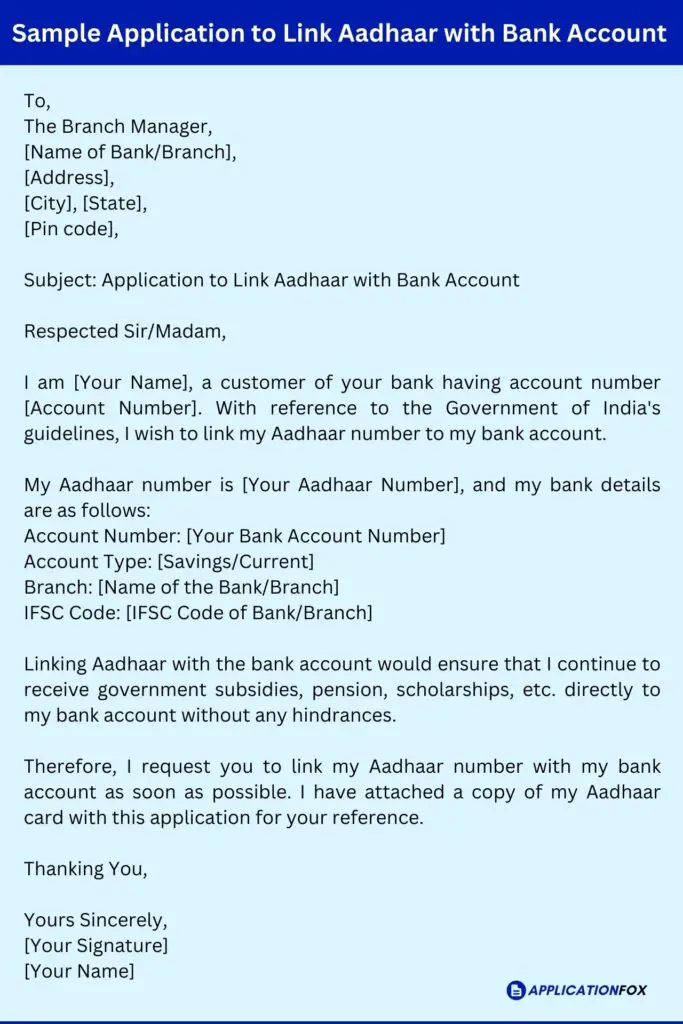

Sample Application to Link Aadhaar with Bank Account format

To,

The Branch Manager,

[Name of Bank/Branch],

[Address],

[City], [State],

[Pin code],

Subject: Application to Link Aadhaar with Bank Account

I am [Your Name], a customer of your bank having account number [Account Number]. With reference to the Government of India’s guidelines, I wish to link my Aadhaar number to my bank account.

My Aadhaar number is [Your Aadhaar Number], and my bank details are as follows:

Account Number: [Your Bank Account Number]

Account Type: [Savings/Current]

Branch: [Name of the Bank/Branch]

IFSC Code: [IFSC Code of Bank/Branch]

Linking Aadhaar with the bank account would ensure that I continue to receive government subsidies, pension, scholarships, etc. directly to my bank account without any hindrances.

Therefore, I request you to link my Aadhaar number with my bank account as soon as possible. I have attached a copy of my Aadhaar card with this application for your reference.

Yours Sincerely,

[Your Signature]

[Your Name]

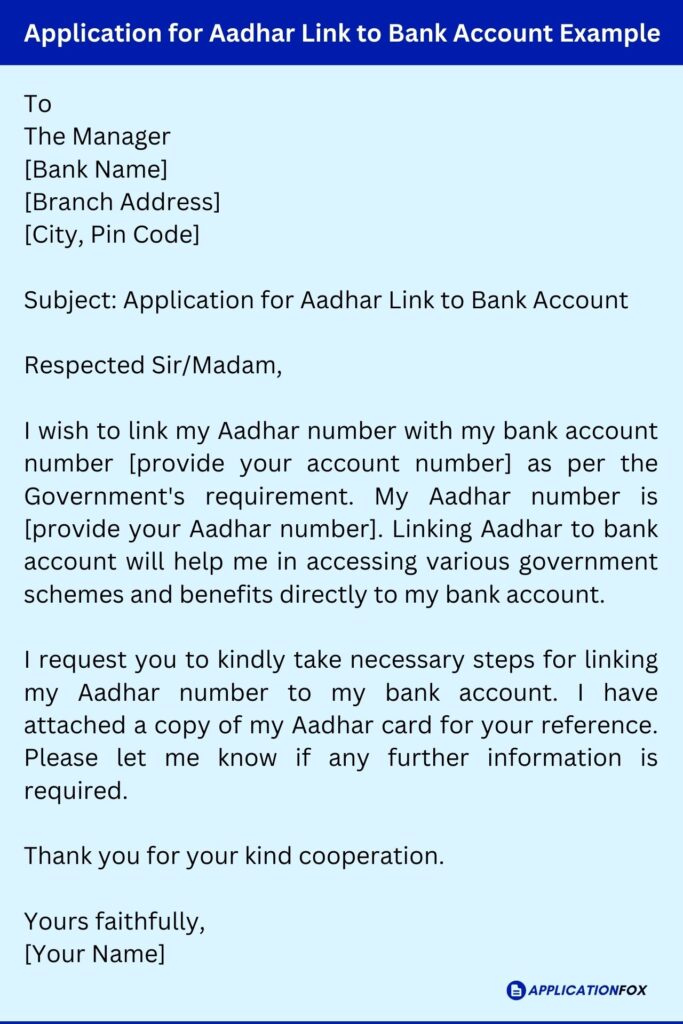

Application for Aadhar Link to Bank Account Example

To

The Manager

[Bank Name]

[Branch Address]

[City, Pin Code]

Subject: Application for Aadhar Link to Bank Account

I wish to link my Aadhar number with my bank account number [provide your account number] as per the Government’s requirement. My Aadhar number is [provide your Aadhar number]. Linking Aadhar to bank account will help me in accessing various government schemes and benefits directly to my bank account.

I request you to kindly take necessary steps for linking my Aadhar number to my bank account. I have attached a copy of my Aadhar card for your reference. Please let me know if any further information is required.

Thank you for your kind cooperation.

Yours faithfully,

[Your Name]

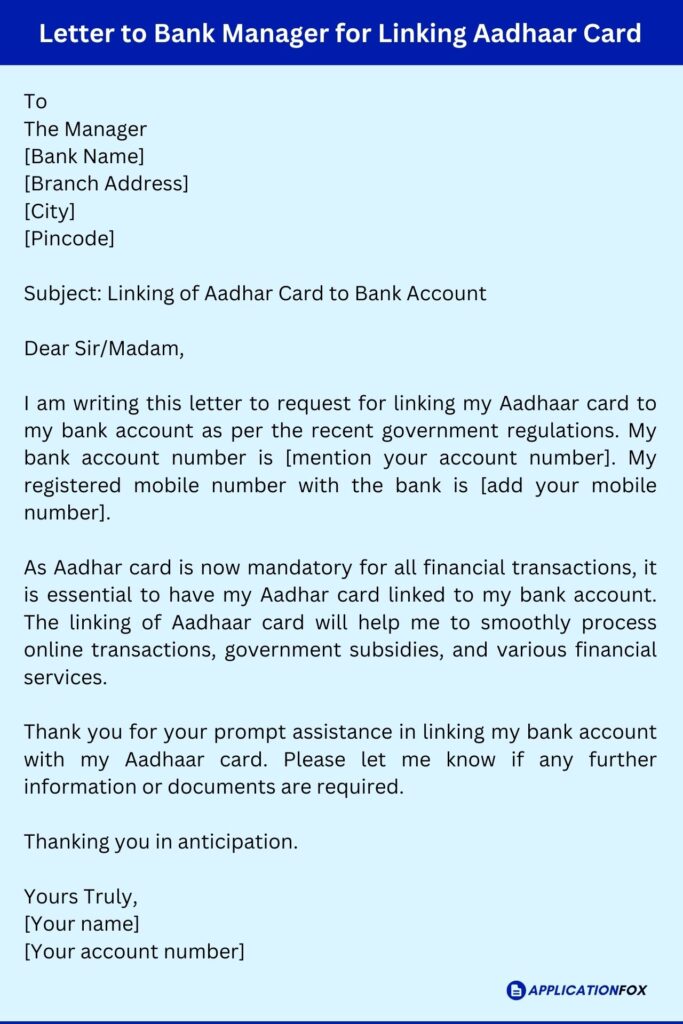

Request Letter to Bank Manager for Linking Aadhaar Card

To

The Manager

[Bank Name]

[Branch Address]

[City]

[Pincode]

Subject: Linking of Aadhar Card to Bank Account

I am writing this letter to request for linking my Aadhaar card to my bank account as per the recent government regulations. My bank account number is [mention your account number]. My registered mobile number with the bank is [add your mobile number].

As Aadhar card is now mandatory for all financial transactions, it is essential to have my Aadhar card linked to my bank account. The linking of Aadhaar card will help me to smoothly process online transactions, government subsidies, and various financial services.

Thank you for your prompt assistance in linking my bank account with my Aadhaar card. Please let me know if any further information or documents are required.

Thanking you in anticipation.

Yours Truly,

[Your name]

[Your account number]

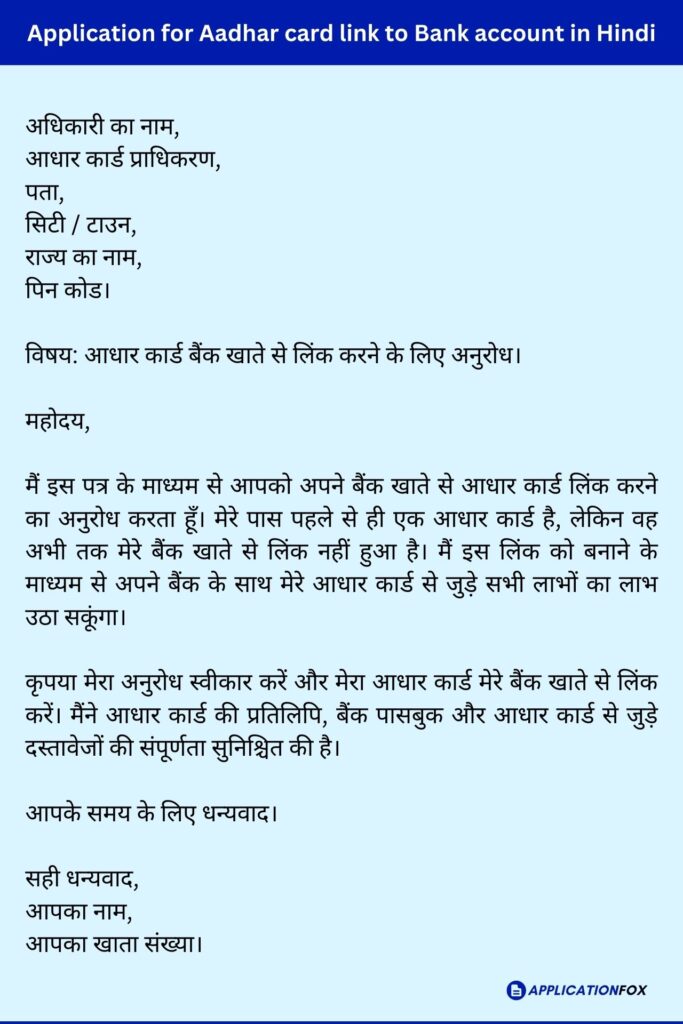

Application for Aadhar card link to Bank account in Hindi

अधिकारी का नाम,

आधार कार्ड प्राधिकरण,

पता,

सिटी / टाउन,

राज्य का नाम,

पिन कोड।

विषय: आधार कार्ड बैंक खाते से लिंक करने के लिए अनुरोध।

मैं इस पत्र के माध्यम से आपको अपने बैंक खाते से आधार कार्ड लिंक करने का अनुरोध करता हूँ। मेरे पास पहले से ही एक आधार कार्ड है, लेकिन वह अभी तक मेरे बैंक खाते से लिंक नहीं हुआ है। मैं इस लिंक को बनाने के माध्यम से अपने बैंक के साथ मेरे आधार कार्ड से जुड़े सभी लाभों का लाभ उठा सकूंगा।

कृपया मेरा अनुरोध स्वीकार करें और मेरा आधार कार्ड मेरे बैंक खाते से लिंक करें। मैंने आधार कार्ड की प्रतिलिपि, बैंक पासबुक और आधार कार्ड से जुड़े दस्तावेजों की संपूर्णता सुनिश्चित की है।

आपके समय के लिए धन्यवाद।

सही धन्यवाद,

आपका नाम,

आपका खाता संख्या।

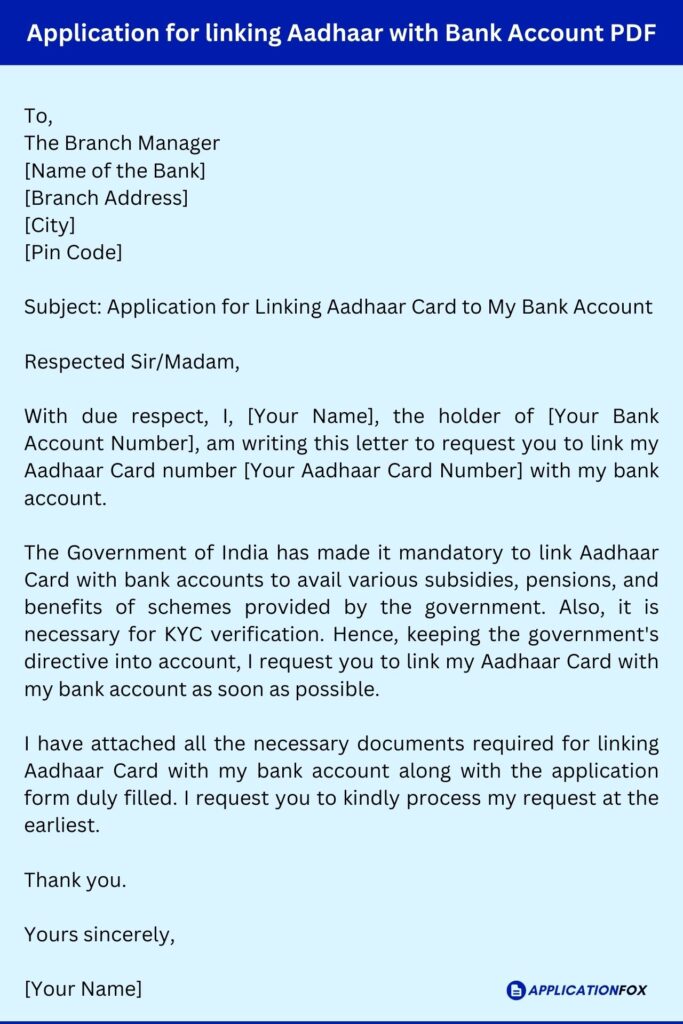

Sample Application for linking Aadhaar with Bank Account PDF

To,

The Branch Manager

[Name of the Bank]

[Branch Address]

[City]

[Pin Code]

Subject: Application for Linking Aadhaar Card to My Bank Account

With due respect, I, [Your Name], the holder of [Your Bank Account Number], am writing this letter to request you to link my Aadhaar Card number [Your Aadhaar Card Number] with my bank account.

The Government of India has made it mandatory to link Aadhaar Card with bank accounts to avail various subsidies, pensions, and benefits of schemes provided by the government. Also, it is necessary for KYC verification. Hence, keeping the government’s directive into account, I request you to link my Aadhaar Card with my bank account as soon as possible.

I have attached all the necessary documents required for linking Aadhaar Card with my bank account along with the application form duly filled. I request you to kindly process my request at the earliest.

Application for Linking Aadhaar with Bank Account Format: Things to Consider

Linking Aadhaar with a bank account has become a mandatory requirement in India, and it is crucial to write a proper application to complete the linking process. Writing an application for linking Aadhaar with the bank account may seem daunting, but it is a straightforward process if done correctly.

Components of a Proper Application

A proper application for linking Aadhaar with a bank account should include the following components:

- Address the application correctly: Address the application to the relevant authority in your bank and include your full name, address, and contact details.

- Use a formal tone: Use a formal tone while writing the application and make sure it is free from any grammatical errors.

- State the purpose of the application: Begin the application by stating the purpose of the application, which is to link your Aadhaar card with your bank account.

- Provide your Aadhaar card details: Provide your Aadhaar card details, such as your Aadhaar number, name, date of birth, and address. This will help the bank verify your identity.

- Provide your bank account details: Provide your bank account details, such as your account number and bank branch, in which you want to link your Aadhaar card.

- Sign the application: End the application by signing it and provide the date of submission.

Structuring the Application

The application for linking Aadhaar with a bank account should be structured in the following manner:

- Salutation: Begin the application with a salutation, such as “Dear Sir/Madam.”

- Introduction: In the introduction, state the purpose of the application, which is to link your Aadhaar card with your bank account.

- Personal details: In this section, provide your personal details, such as your full name, address, contact number, and Aadhaar card details.

- Bank account details: Provide your bank account details, such as your account number and bank branch, in which you want to link your Aadhaar card.

- Closure: In the closure, thank the bank authority for their assistance and sign the application.

By following the components of a proper application and structuring the application correctly, individuals can easily write a compelling application to link their Aadhaar card with their bank account. The guidelines provided here will be helpful in making the application process smooth and hassle-free.

FAQs

Why is linking Aadhaar with bank account mandatory?

It is a government directive aimed at curbing money laundering and ensuring transparency in financial transactions.

How to link Aadhaar with bank account?

Visit your bank, fill out the required application form, provide a copy of your Aadhaar card and submit it to the bank.

What happens if I don’t link my Aadhaar with bank account?

The account may be frozen, and transactions may be prohibited until Aadhaar is linked to the account.

Related posts:

- Application for Closing Bank Account – 10+ Samples, Formatting Tips, and FAQs

- Bank Passbook Missing Letter – 8+ Samples, Formatting Tips, and FAQs

- Application for Mobile Number Registration in Bank – 6+ Samples, Formatting Tips, and FAQs

- Application for Changing Signature in Bank – 5+ Samples, Formatting Tips, and FAQs

- Application for Name Change in Bank Account – 11+ Samples, Formatting Tips, and FAQs

- Application for Unblock Atm Card – 3+ Samples, Formatting Tips, and FAQs